The global hydrogen industry has seen remarkable growth, with a seven-fold increase in investment for projects reaching Final Investment Decision (FID) in the past four years. While the industry faces challenges as it scales, the progress made since the first publication of Hydrogen Insights in 2021 demonstrates the significant efforts of industry leaders and governments to drive clean hydrogen forward.

From just 102 committed projects in 2020, representing USD 10 billion in investment, the number of hydrogen projects reaching FID surged to 434 in 2024, with investments now totaling USD 75 billion. Key drivers for this success include strong policy incentives such as the 45Q tax credit in the United States, demand visibility through instruments like Japan’s contract-for-difference for hydrogen power, and industrial policies in regions like China that are driving down costs through large-scale deployment.

Maturing Industry with Growing Project Pipeline

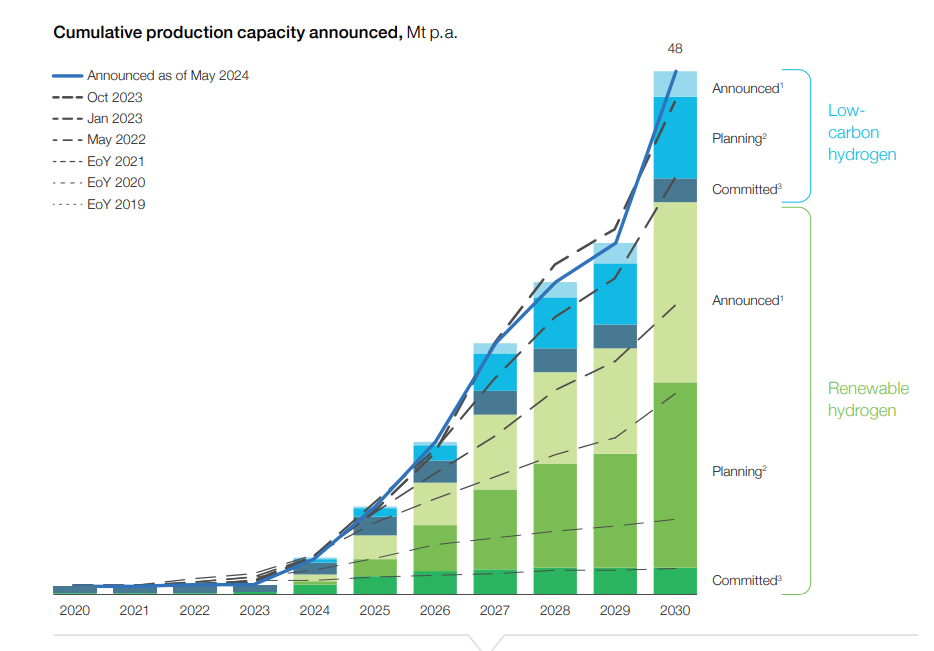

The global hydrogen project pipeline has grown exponentially, from 228 projects in 2021 to 1,572 in 2024. Moreover, the industry is maturing as more projects progress beyond announcements to the Front End Engineering Design (FEED) stage. Investments in FEED-stage projects have increased twenty-fold since 2020, indicating greater project maturity and readiness for execution.

As the industry matures, natural attrition has helped phase out less viable projects, focusing on those with the highest potential. This pattern mirrors the early years of the wind and solar industries, where only 10-20% of initial project developments reached commissioning, and similar trends are being observed in other fast-growing climate technologies like battery production.

Navigating Regulatory and Economic Challenges

Despite the progress, the hydrogen industry faces significant headwinds. Rising inflation, interest rates, global energy market disruptions, and higher-than-expected renewable electricity prices have caused delays and cancellations, particularly for renewable hydrogen projects. Additionally, regulatory uncertainty, such as the pending implementation of RED III at the Member State level and the rulebook for the IRA 45V, has hindered project bankability and slowed growth.

Given these delays, it’s estimated that only 12-18 Mt of the 48 Mt of annual hydrogen supply announced could be deployed by 2030. However, regions like North America are benefiting from robust policy incentives, with over 90% of global low-carbon hydrogen capacity that passed FID last year being located in the region, driven by strong measures like the 45Q tax credit.

Scaling for Climate Goals: The Road Ahead

While the seven-fold increase in hydrogen investments is impressive, the current pace and scale are not sufficient to stay on track with global climate commitments. To accelerate energy system decarbonization and meet climate goals, hydrogen investments need to increase eight-fold by 2030, far surpassing the current USD 75 billion in FID projects.

Achieving this requires concerted efforts from governments and industry. Policy incentives and clear regulatory frameworks are crucial for mobilizing private capital and accelerating project development. Over the next two years, ensuring regulatory clarity and support for demand drivers will be critical to tackling delays and developing the necessary midstream infrastructure.

Together, decision-makers have a unique opportunity to build on the undeniable progress made in the past four years. By accelerating investments and addressing barriers, the hydrogen sector can unlock both environmental and economic gains, advancing the global transition to a clean energy future.

Read more and download the full report: