Green hydrogen has emerged as a key component in the global strategy to combat climate change and transition to a sustainable energy system. Produced using renewable energy to electrolyze water, green hydrogen is seen as a vital solution for decarbonizing sectors that are challenging to electrify, such as heavy industry and long-distance transport. This article provides an overview of the real-world development of green hydrogen capacity from 2021 to 2030, based on industry data and forecasts.

Early Growth Phase (2021-2023)

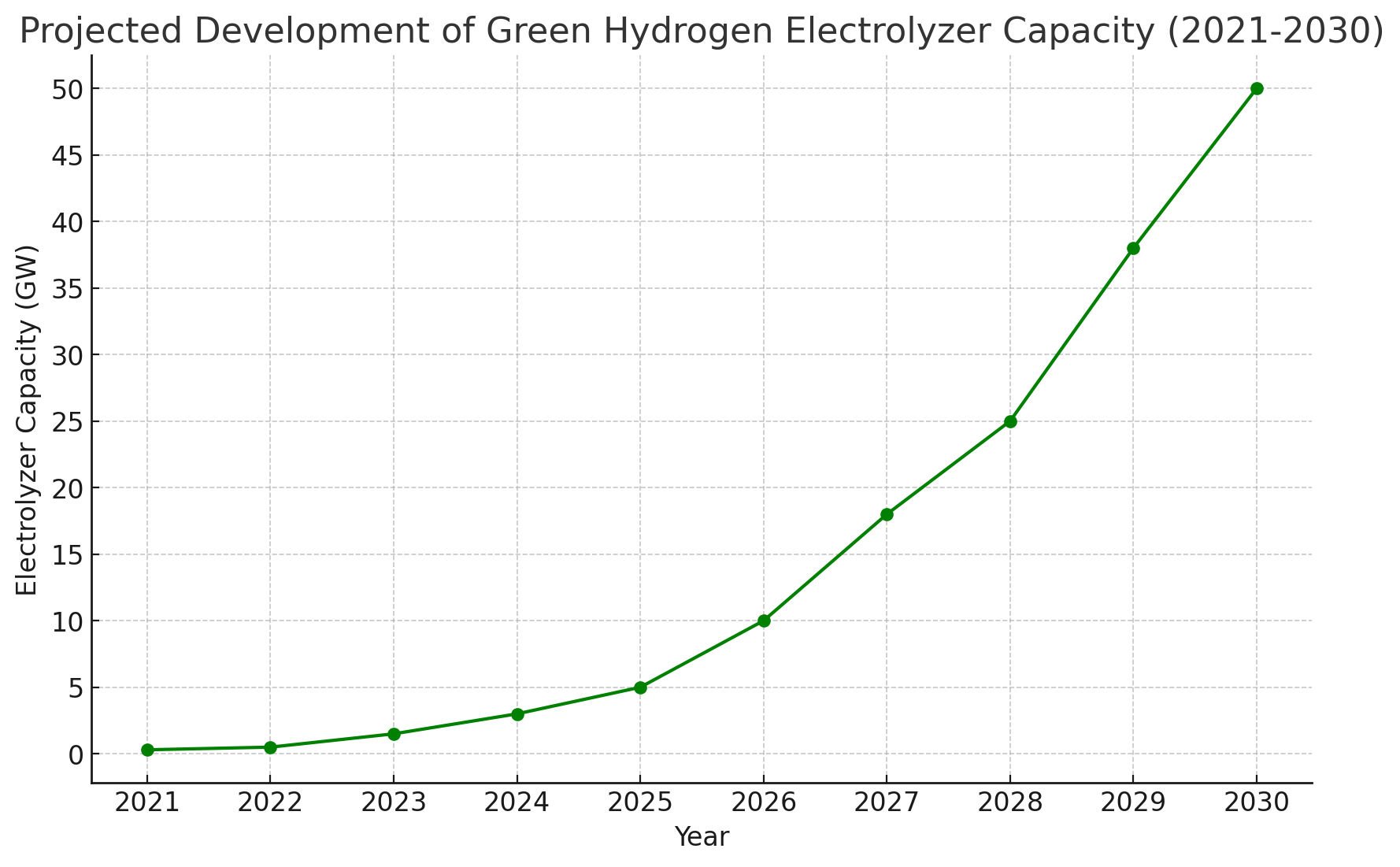

The green hydrogen industry started gaining momentum around 2021, with global electrolyzer capacity at approximately 0.3 gigawatts (GW). This early stage was characterized by pilot projects and the establishment of initial infrastructure, supported by government initiatives and investments aimed at reducing greenhouse gas emissions.

By 2023, the global electrolyzer capacity had grown to around 1.5 GW. This growth was driven by significant policy support in regions like the European Union, where the European Green Deal emphasized hydrogen as a priority for achieving climate neutrality by 2050. Additionally, countries such as China, Japan, and Australia began investing heavily in green hydrogen, recognizing its potential to complement their renewable energy ambitions.

Acceleration Phase (2024-2027)

The period between 2024 and 2027 is projected to witness a rapid acceleration in green hydrogen development. By 2027, global electrolyzer capacity is expected to reach 18 GW, reflecting a significant scale-up in both production and deployment.

Key factors driving this growth include:

Cost Reductions: Technological advancements and economies of scale are expected to reduce the cost of electrolyzers and renewable energy, making green hydrogen more competitive with traditional hydrogen and fossil fuels.

Expanded Industrial Applications: Heavy industries, such as steel and chemical production, are beginning to adopt green hydrogen at scale, supported by regulatory incentives and the need to meet decarbonization targets.

Global Partnerships: International collaborations, particularly in Europe and Asia, are fostering the development of large-scale green hydrogen projects and infrastructure, including pipelines and storage facilities.

Growing Industry Leaders: Numerous companies are at the forefront of the green hydrogen revolution, driving technological innovation and capacity expansion. Among the leading players are:

- Plug Power: A pioneer in hydrogen fuel cell technology and green hydrogen production.

- Nel ASA: A Norwegian company specializing in hydrogen production plants and fueling stations.

- ITM Power: A UK-based firm that develops electrolyzer technology for producing green hydrogen.

- Siemens Energy: A global energy company investing heavily in green hydrogen projects.

- Air Liquide: A major industrial gas company expanding its green hydrogen production capabilities.

- Linde: Another industrial gas giant focused on building green hydrogen infrastructure.

- Ballard Power Systems: A leading developer of hydrogen fuel cell systems.

- Cummins: Known for its engines and power generation, Cummins is also advancing in electrolyzer technology.

- Thyssenkrupp: A German industrial conglomerate that is developing large-scale electrolyzers.

- ENGIE: A French multinational with significant investments in green hydrogen projects.

- Shell: While traditionally an oil and gas company, Shell is now heavily investing in green hydrogen.

- BP: Another oil major pivoting towards renewable energy and green hydrogen.

- TotalEnergies: A French energy giant expanding its green hydrogen production portfolio.

- ReNew Power: An Indian renewable energy company entering the green hydrogen market.

- Copenhagen Infrastructure Partners: A Danish firm investing in large-scale green hydrogen projects.

- Enel Green Power: The renewable energy arm of Italy’s Enel, focusing on green hydrogen initiatives.

- Fortescue Future Industries: An Australian company making significant strides in green hydrogen production.

- NextEra Energy: A major U.S. utility company venturing into green hydrogen.

- Hyzon Motors: A global supplier of hydrogen fuel cell-powered commercial vehicles.

- FuelCell Energy: Specializes in fuel cell technology and is expanding into green hydrogen.

Maturation Phase (2028-2030)

As green hydrogen moves into the late 2020s, the industry is projected to enter a maturation phase, with global electrolyzer capacity potentially reaching 50 GW by 2030. This phase will be characterized by:

Widespread Adoption: Green hydrogen will become a mainstream energy source, with applications in transport, industry, and power generation. Hydrogen refueling stations, green ammonia production, and hydrogen-powered shipping are likely to become more common.

Infrastructure Development: The infrastructure to produce, transport, and store hydrogen will expand significantly, including cross-border pipelines and integrated energy networks that link renewable energy generation with hydrogen production hubs.

Global Market Integration: A global market for green hydrogen is expected to develop, with countries exporting hydrogen produced from renewable sources to regions with less access to affordable renewables. This will create a new dynamic in global energy trade.

Conclusion

The decade from 2021 to 2030 represents a pivotal period for green hydrogen, with the industry poised for substantial growth. Starting from a modest base, the global electrolyzer capacity is projected to expand to 50 GW by 2030. This growth will be driven by technological advancements, supportive policies, and the increasing demand for sustainable energy solutions.

As green hydrogen continues to develop, it will play a crucial role in achieving global climate goals and transforming the energy landscape, offering a viable pathway to decarbonize sectors where direct electrification is not feasible. The data and projections outlined in this article underscore the potential of green hydrogen to become a cornerstone of the global energy transition in the coming decades.

Sources:

International Energy Agency (IEA). (2021). The Future of Hydrogen. Retrieved from https://www.iea.org/reports/the-future-of-hydrogen

Hydrogen Council. (2022). Hydrogen Insights Report 2022. Retrieved from https://hydrogencouncil.com/en/hydrogen-insights-2022/

BloombergNEF. (2023). Green Hydrogen Outlook 2023. Retrieved from https://about.bnef.com/blog/green-hydrogen-outlook-2023/

European Commission. (2020). A Hydrogen Strategy for a Climate-Neutral Europe. Retrieved from https://ec.europa.eu/energy/sites/ener/files/hydrogen_strategy.pdf